25+ pmi on reverser mortgage

Ad Compare the Best Reverse Mortgage Lenders. Get A Free Information Kit.

Why Do People Say That If You Sell Your House Within Five Years Of Getting A Mortgage You Will Lose Money Quora

Web If you take out a 150000 reverse mortgage at 5 interest on a 200000 house and you dont pay it back for 25 years you or your family will owe a whopping.

. Ad While there are numerous benefits to the product there are some drawbacks. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. For Homeowners Age 61.

You were late or missed paying your property charges which includes. Department of Housing and Urban Developments. Web A reverse mortgage increases your debt and can use up your equity.

For Homeowners Age 61. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Get A Free Information Kit.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Web A reverse mortgage is a type of loan reserved for seniors ages 62 and older which does not require monthly mortgage payments. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Web There are several ways you may have fallen into default on your reverse mortgage loan. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Heres how it works and how.

Web Most reverse mortgages today are Home Equity Conversion Mortgages HECMs which are federally insured by the US. Ad Our Reviews and Recommendations Are Trusted By 45000000 Customers. For Homeowners Age 61.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. For Homeowners Age 61. Unlike a conventional mortgage your lender pays you in monthly.

Ad Compare the Best Reverse Mortgage Lenders. Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

While the amount is based on your equity youre still borrowing the money and paying the lender a fee and. Web A reverse mortgage is a loan where the lender pays you in a lump sum a monthly advance a line of credit or a combination of all three while you continue to live. Compare a Reverse Mortgage with Traditional Home Equity Loans.

Web A reverse mortgage is a loan based on the paid-up current value or equity in your home. Web Reverse mortgages have costs that include lender fees origination fees are capped at 6000 and depend on the amount of your loan FHA insurance charges and. In addition the loan may need to be paid back sooner such as if you fail to pay.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

4 Application Fees Disclosures Reverse Mortgage

What S Reverse Mortgage Insurance

:max_bytes(150000):strip_icc()/Womangardeninginfrontyard-fc3e89c4e7164bc29486386b8ac4939a.jpeg)

Do Reverse Mortgage Loans Require Mortgage Insurance

What Is Pmi Understanding Private Mortgage Insurance

Galina Tatulyan Option 1 Mortgage Llc Farmington Hills Mi

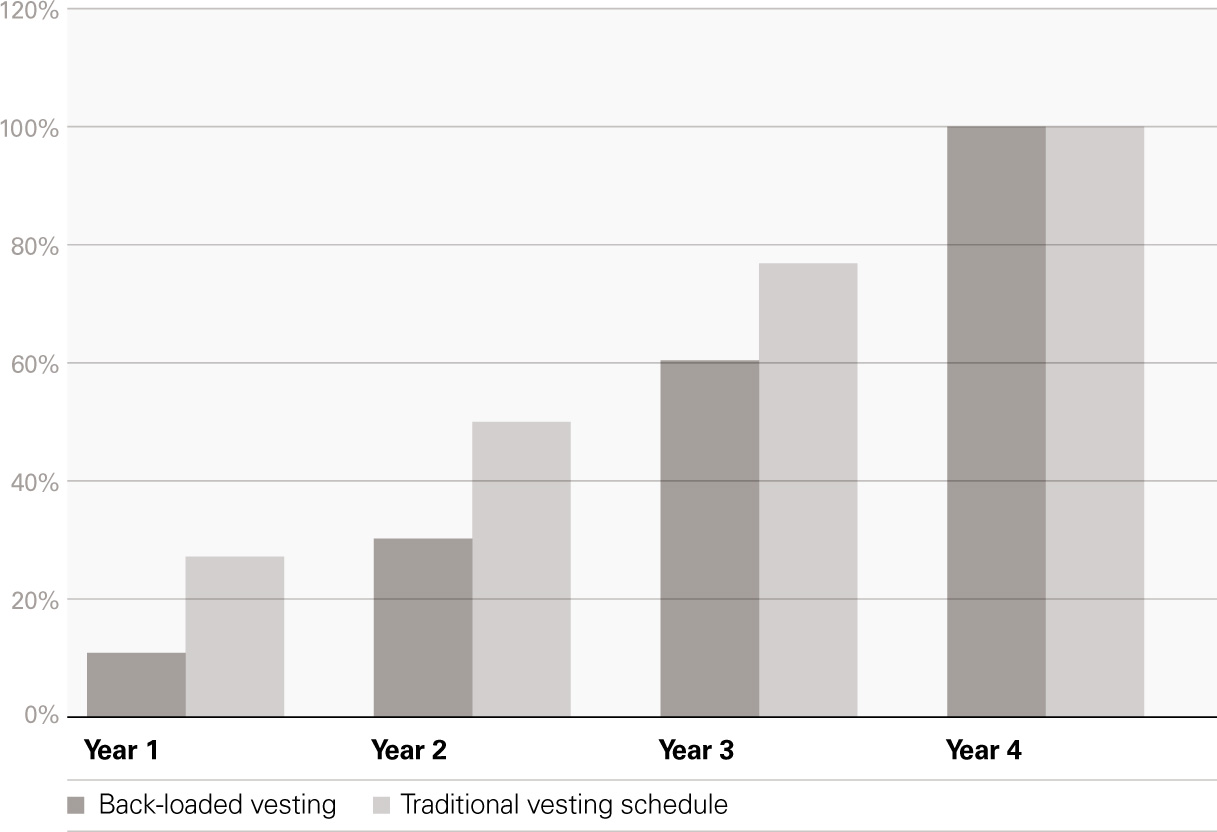

Rewarding Talent Esop Rules Index Ventures

Galina Tatulyan Option 1 Mortgage Llc Farmington Hills Mi

Private Mortgage Insurance Pmi When It S Required And How To Remove It

How To Avoid Paying Private Mortgage Insurance Pmi

What Is Pmi On A Mortgage And What You Can Do To Avoid It

What Is Private Mortgage Insurance Pmi And How Does It Work Ramsey

5 Important Things To Know About Fha Loans

Mortgage Insurance Premiums On Reverse Mortgages

What S Reverse Mortgage Insurance

Gift Of Equity Complete Guide On Gift Of Equity In Detail

What Is Pmi Understanding Private Mortgage Insurance

A Quick Guide To Va Loans In Texas